Can the Buy Now, Pay Later industry survive a recession?

Banks and financial institutions can benefit from BNPL innovation and leveraging new customer data flows to dampen the impact of a recession, argues CI&T’s David Ritter

-

David Ritter

- September 27, 2022

- 4 minutes

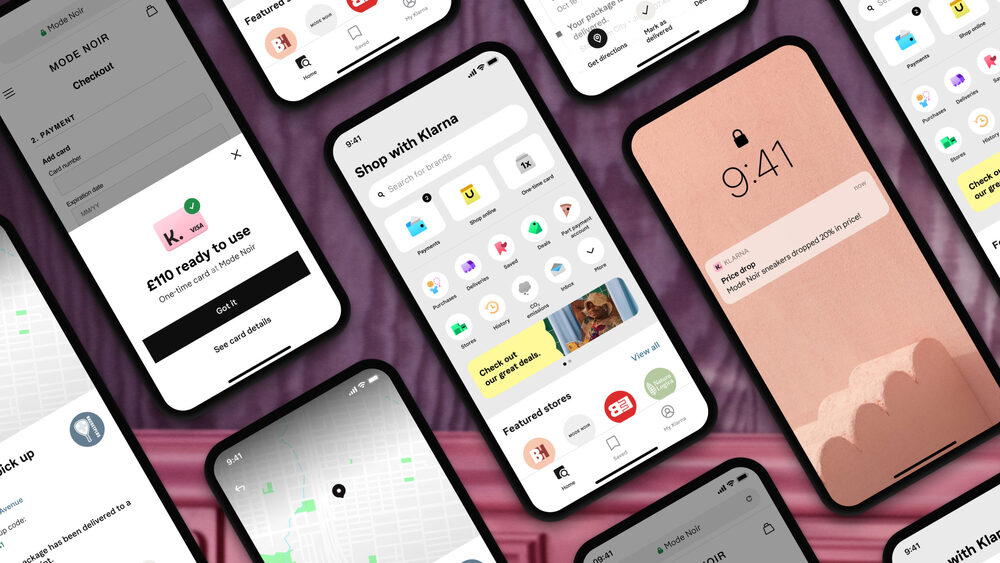

Buy Now, Pay Later (BNPL) might seem ultra-modern thanks to its ubiquity with Gen Z’s favourite retailers, but the concept is as old as credit itself. Instead, BNPL’s uniqueness comes from a seamless digital delivery as part of an online shopping journey. Want that new ASOS jacket but don’t have the funds? Forget borrowing from friends and family or putting it all on the credit card at once—simply tap ‘Pay with Klarna’ to instantly order the product and split the cost into smaller, more affordable chunks.

Incumbent banks and payment providers may feel they missed out on the early BNPL boom. But instalment credit is also a risky investment, particularly when customers overextend themselves. Lenders like Klarna and Laybuy operate on a different model to credit cards. And while BNPL might be a popular option in a cost-of-living-crisis as disposable income shrinks, it’s also particularly vulnerable to this. With more consumers struggling financially, inabilities to meet payment deadlines now threaten the longevity of the industry. In July, Klarna’s year-on-year valuation plunged by 85%, and recently it revealed that losses more than tripled in the first half of the year. So, how might Buy Now, Pay Later survive an upcoming recession?

-

Lenders will start to turn people down

BNPL differs from credit cards, which are an open line of credit. This allows customers to make regular withdrawals up to an agreed limit and only pay interest on what they borrow. During the 2008 financial crisis, banks closed their customers’ inactive credit cards to cushion themselves against record loan losses.

However, BNPL businesses cover a collection of one-time purchases and are unable to reduce credit lines. To ward off losses, lenders are instead likely to tighten up consumer eligibilities and even limit the sizes of loans. We’re already seeing this with Klarna—the CEO stated in August that the company will start to “lend a little less sometimes, especially to new consumers.”

-

A lack of visibility will require better BNPL reporting

Currently, there isn’t uniform credit bureau reporting of buy now, pay later borrowing. When a customer uses a BNPL service, the lender doesn’t know how many different debts the customer is already carrying, and whether they’re a model loanee who pays back on time—or someone who’s already saddled with several overdue repayments.

A similar phenomenon occurred with Lending Club and online unsecured lenders in the peer-to-peer boom of eight to ten years ago. Poor reporting meant lenders failed to detect the ‘stacking’ of multiple loans from different companies by consumers, leading to rising obligations, inabilities to repay, and increased risks of defaulting. This again contrasts with credit cards, which are highlighted on customers’ credit reports for informed lending decisions.

More: Klarna partners with Experian, TransUnion on BNPL credit reporting

The integration of open banking may help to improve BNPL reporting. However, consumers would need to agree to share their data. And while responsible borrowers are likely to do so, those who struggle to repay may refuse consent to protect their future borrowing prospects.

-

BNPL businesses must adapt to remain relevant

As Jack Dorsey, founder of Twitter, says, “there’s no better time to start a new company or a new idea than a depression or recession.” So, lenders must continue to invest and innovate to ensure continued growth and find new profitable avenues. In August, Klarna began reinventing itself as a one-stop-ecommerce-shop that enables customers to track all of their online purchases on one platform, regardless of the retailer or payment method.

Current fears of a recession present significant market opportunities to banks and financial service providers. New offerings that draw in all account and transaction data to help consumers and small businesses budget, save, and invest are likely to be the future of the industry. In a dip, it’s all about managing cash flows—BNPL lenders must make sure that they continue to innovate, revamping their business models to help consumers navigate crises. Only then can they cement themselves as key players in financial services for many years to come.

Bobsguide is a

Bobsguide is a