Why the humble password is your biggest fintech liability

The single biggest threat to fintech security isn’t advanced AI. It’s the simple, shared, or reused password. With the cost of a breach pushing $4.9 million, discover why modern access control must move from chaotic spreadsheets to a zero-trust vault architecture.

-

Nikita Alexander

- October 8, 2025

- 4 minutes

Let’s be honest: in the high-stakes world of fintech, the single biggest security failure point isn’t some zero-day vulnerability. It’s the password.

Despite the billions poured into next-gen AI and sophisticated perimeter defenses, the humble, often-reused, sometimes-shared-on-a-spreadsheet credential remains the easiest path into your network. According to Surfshark, over 5.5 billion accounts were impacted by breaches in 2024, an eightfold jump from the year before.

The simple truth is: we’ve collectively failed to secure the front door.

For compliance-driven, high-trust sectors like banking and fintech, leaving password management to individual memory or unsecured documents isn’t just a lapse; it’s a ticking time bomb. It’s time to retire the messy, manual processes and treat enterprise password management as the critical infrastructure it is.

The Unmanaged Credential Crisis

A weak password is a direct, quantifiable hit to your bottom line, extending far beyond the initial breach notification. The impact manifests in three critical areas:

- The Operational Drag

Your employees aren’t spending their time innovating; they’re spending it hunting for credentials. On average, employees burn 26 hours annually just dealing with forgotten or broken passwords. Multiply that across your organization, and that “little issue” quickly becomes a $480 per person tax on lost productivity. It’s death by a thousand cuts for your IT budget.

- The Compliance Catastrophe

If your access management relies on spreadsheets or shared team memories, you’ve already failed the audit. Frameworks like ISO 27001:2022 and SOC 2 demand ironclad, auditable access controls and activity logs. Can your current system tell an auditor precisely who accessed what, when, and from where? If the answer is “we think so,” you have a serious compliance gap.

- The Ex-Employee Nightmare

The offboarding process is a notorious vulnerability. How confident are you that every single credential and access point is revoked the minute a key employee walks out the door? Most IT leaders aren’t. That unrevoked login is a perpetual license for a former staffer to access systems, presenting both a security and an insider risk. Central control is the only defense.

The Only Way Out

To neutralize the password threat, the solution cannot just be a better spreadsheet; it must be a zero-trust, cryptographically secured vault. This is where modern password management platforms come into play, offering a centralized solution to secure, manage, and streamline credential handling across the enterprise.

This requires two non-negotiable architectural standards for any enterprise solution:

- Zero-Knowledge Security: This is your privacy guarantee. The provider of the vault should never, under any circumstances, have the key to access your stored data. Only authorized users within your organization can view the information.

- Next-Gen Cryptography: The security isn’t just about privacy; it’s about strength. Leading solutions are moving beyond older standards, adopting modern encryption like XChaCha20. NordPass Business, for example, is currently a major password manager using this standard, ensuring the data is virtually impossible to crack without the correct key.

Look for platforms that have put their money where their mouth is, securing independent validation like ISO 27001:2022 and SOC 2 Type 2 certifications, which NordPass Business holds.

Policy Enforcement, Minus the Pain

A password manager’s true value for a CISO lies in its ability to enforce policy at scale without crippling workflow. The tool needs to be the central nervous system for access.

Risk Visibility on Demand

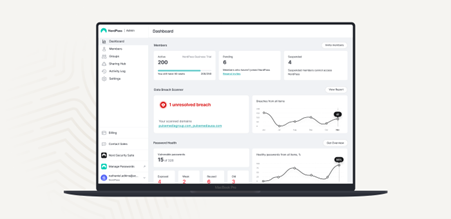

You can’t fix what you can’t see. Your platform must include a Password Health Dashboard that flags weak, reused, old, or exposed credentials before an attacker can find them. Proactive domain scanning is equally essential for breach detection.

Total Access Governance

Administrators need granular control over the keys to the kingdom. This includes the ability to enforce Multi-Factor Authentication (MFA) across all users, set mandatory password complexity rules, and instantly revoke sharing access via a central Sharing Hub when a staff member changes roles or exits the company.

Audit-Ready Logging

Security teams must be able to integrate credential activity into their wider ecosystem. Look for solutions with an Activity Log that can export data or integrate directly with SIEM tools (like Splunk or Microsoft Sentinel). This turns chaotic access data into clear, regulatory-friendly audit trails.

A comprehensive platform, like NordPass Business, also includes built-in authentication features, such as a dedicated Authenticator with biometric protection, allowing teams to securely generate TOTPs for shared accounts without relying on a single device owner.

The End of the Spreadsheet Era

The age of manual, insecure, and compliance-killing password management is over. For financial institutions navigating a complex regulatory and threat environment, a scalable, secure, and user-centric password management system is the low-friction bedrock upon which all other security strategy is built.

NordPass Business meets this challenge by simplifying password security, supporting compliance, and reducing the acute risks associated with credential misuse.

Bobsguide is a

Bobsguide is a