From Early Experimentation to Industry Essential

A year ago, embedded finance was still regarded as an add-on, a way to modernise customer experiences through financial functionality. By 2025, it has become a core element of platform strategy across retail, fintech, and technology sectors.

Opening the session, Renata Caine revealed new data from more than 500 industry leaders showing that 94% plan to invest in embedded finance within the next year, up from 82% in 2024. “Trust remains the currency of embedded finance,” she said. “It’s no longer about whether it’s coming; it’s about doing it right.”

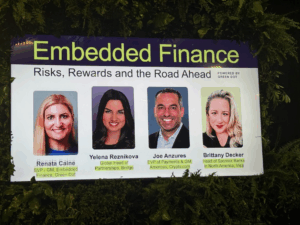

Renata Caine, SVP & GM of Embedded Finance at Green Dot

For Caine, the data reflects a clear transition. Embedded finance has matured into an operational reality where consistency, not experimentation, drives success.

Partnerships at the Core of Progress

The panel that followed, featuring Visa’s Brittany Decker, Bridge’s Yelena Reznikova, and Crypto.com’s Joe Anzures, underscored that partnerships remain the lifeblood of embedded finance.

Brittany Decker described the sector’s momentum as a direct response to consumer expectations. “If you’re not innovating, someone else will,” she said. “User experience builds loyalty, and friction destroys it.”

Yelena Reznikova, whose company Bridge was acquired by Stripe earlier this year, noted that “everyone wants to partner with a fintech” rather than become one. “It’s about finding agile partners that can evolve with regulation rather than be constrained by it,” she added.

For Joe Anzures, transparency and trust are the foundation of progress. “We’ve built named accounts and real-time settlement to give users confidence in how their money moves,” he said. “It’s about removing friction without removing accountability.”

Regulation as a New Era of Constructive Clarity

If 2024 was defined by uncertainty, 2025 marks the start of a more confident regulatory era. The GENIUS Act has brought long-awaited clarity to stablecoin and embedded payment providers, even if the finer details are still to come.

Caine observed that security concerns have fallen from 50% to 39% since last year; a sign that financial institutions are becoming more comfortable with compliance. Decker described this as a healthy evolution: “Good regulation comes with embedded trust. It creates the guardrails that let innovation scale safely.”

Anzures added that transparent data sharing and redundancy in partnerships are helping firms mitigate disruption and build confidence. “For us, it’s about staying flexible and pivoting quickly without losing momentum,” he said.

From Stablecoins to Agentic Commerce

Reznikova predicted that stablecoins will drive a new wave of cross-border innovation. “We’re seeing U.S. merchants adopt stablecoins not for hype, but for reach, enabling customers globally with lower fees and faster transactions,” she explained.

Decker pointed to the rise of agentic commerce, where AI-powered digital agents facilitate smarter and safer purchasing decisions. “Soon, AI agents will manage payments across multiple platforms,” she said. “It’s the next evolution of convenience and control.”

For Caine, the convergence of AI and embedded finance will define the next stage of growth. “The future isn’t just embedded; it’s personalised, predictive, and powered by partnership,” she concluded.

As Caine summed up: “Technology is only half the equation. The rest is how we work together to make finance feel invisible and indispensable.”

Bobsguide is a

Bobsguide is a