AI Decoded 2.0: From Hype to Reality

AI Decoded 2.0, hosted by fintech firm Koodoo, provided substantive insights into the transformative potential of AI in financial services, showcasing practical applications and strategies to navigate the complexities of AI deployment while emphasizing the importance of upskilling and workforce preparation for an AI-driven future.

-

Editorial Team

- May 10, 2024

- 5 minutes

The past year has seen a deluge of conferences, panels, and talks surrounding artificial intelligence, each promising to unlock the mysteries of this transformative technology.

However, amid the hype and fanfare, very few of these events have delivered substantive insights that truly further our understanding of AI’s implications and best practices. Too often, they devolve into self-congratulatory exhibitions or surface-level discussions that fail to grapple with the nuances and complexities inherent to AI development and deployment.

AI Decoded 2.0, run by fintech firm Koodoo, was not one of these events.

“Our mission is to equip human advisors with top-tier tools that allow them to focus on what truly matters – engaging with clients, understanding their unique needs, and delivering tailored advice,” said Andrei Lebed – co-founder and CEO of Koodoo – during his opening remarks.

Koodoo is not a new player within the fintech market – for several years, it has provided a bridge between homeowners and mortgage providers.

Since 2022, however, the company has been leveraging AI within its service offering to power the mortgage verticals of UK lenders, renowned comparison brands and leading fintechs.

Achieving CeMAP success

During the event, Lebed announced Koodoo’s AI offering had passed the UK Certificate in Mortgage Advice Practice (CeMAP) exam, an “industry first”.

“This is a historic breakthrough moment for the mortgage industry,” Lebed said.

“Having a large language model pass CeMAP opens so many possibilities for artificial intelligence to enhance the productivity of brokers and lenders, ultimately leading to faster and better outcomes for their customers.”

In August 2023, Koodoo’s AI scored over 70% in all three modules of the CeMAP exam papers, and has since improved to an average mark of 94%, surpassing distinction.

The improved capability of Koodoo’s large language model has made it more reliable and will give mortgage advisors greater confidence, Lebed said.

AI prowess

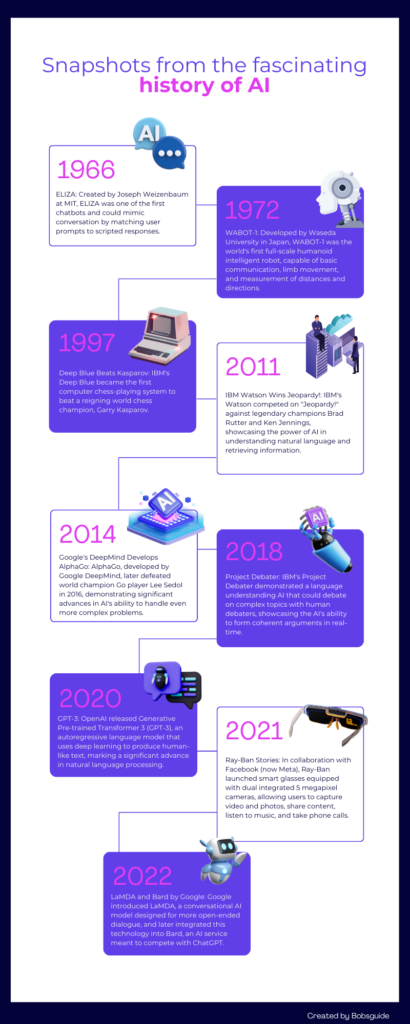

The event highlighted the limitations of traditional chatbots, which were often rigid and unable to truly understand the nuances of human communication.

However, the advent of large language models (LLMs) and the rise of digital assistants like Alexa and Siri have ushered in a new era of conversational AI that is more flexible, contextual, and capable of seamlessly integrating with various workflows.

Koodoo’s foray into AI began in 2023 when it designed its first LLM.

Since then, the fintech has been working to refine its technology and has launched two additional tools into the market. The company’s call-checking tool, for example, enables 100% of calls to be screened and assessed in significantly reduced timeframes compared to manual review methods, effectively flagging any potential missed cues to assist human decision-making.

This not only enhances the accuracy of advisor-client interactions but also frees up valuable time for advisors to focus on building deeper, more personalized relationships with their clients.

In an industry heavily regulated by bodies like the Financial Conduct Authority (FCA), Koodoo’s AI-powered tools have also proven invaluable in ensuring compliance and regulatory adherence.

The company’s document checking tool has an impressive accuracy rate of 98%, which helps clients achieve first-time-right completion for personal identification and Know-Your-Customer verification documents, a significant improvement over the previous manual process.

By streamlining the mortgage application process and providing more accurate and personalized information to customers, Koodoo’s AI-powered tools are also enhancing the overall customer experience.

The company’s newly launched Mortgage in Principle (MIP) chatbot, for example, aims to address the pain points often encountered by early-stage mortgage borrowers, who are typically not well-served by traditional rate comparison processes.

“We don’t think we are in a position to move the accountability of giving advice away from humans,” Lebed said. “Our goal is to create a 99% digital journey with a 1% check at the end, where human advisors can focus on the nuanced aspects of the mortgage process.”

The MIP chatbot provides detailed responses to mortgage-related questions, empowering customers with a better understanding of their borrowing capacity.

Training is essential

Throughout the event, a recurring theme was the importance of upskilling and preparing the workforce for the AI-driven future.

Lebed emphasized the need for companies to invest heavily in upskilling their employees, equipping them with the necessary skills to “hack their productivity” through the use of generative AI tools.

The event also highlighted the growing demand for specialized roles, such as prompt engineers, who possess the ability to effectively direct and guide AI systems to produce desired outputs.

Koodoo’s representatives encouraged attendees to explore resources like the Centre for Generative AI Innovation workshops to stay ahead of the curve and capitalize on the transformative potential of AI in financial services.

Bridging the gap between technology and deployment

Recognizing the challenges that organizations often face in effectively deploying and integrating AI-powered solutions, Koodoo announced the launch of its Koodoo Consulting service.

This offering is designed to provide a 90-minute, no-cost consultation session to help businesses navigate the complexities of the AI landscape and identify the right solutions to address their specific pain points.

Jess Bateson, the commercial and operations director at Koodoo, highlighted the importance of this service.

“There is a gap between implementing off-the-shelf tools and making them truly effective within an organization. Koodoo Consulting aims to bridge that gap, helping businesses harness the full potential of AI-powered solutions,” she said.

For more information, follow Koodoo on Linkedin.

Bobsguide is a

Bobsguide is a